Epic Fail: Four deals that flopped, and how to turn around your deal program

It's not all roses out there in the deal space. Here are some deals that didn't work, and how to adjust your deal program to gain traction.

The anatomy of a failed deal may have to do with the promotional power of the program (see resources below) - or it just may be the deal. This report focuses on the deal, not the good; just the bad, and the really, really ugly. We've looked at some whoppers on this site, so let's take a look at some floppers:

1. The Dirty Deed's Dirty Deal

A deal that doesn't work in a bar setting starts with a restriction that does not include purchase of alcohol. Dirty Deed's Bar & Grill lived up to its name with an offer of $2.50 for $5 for anything but alcohol - even though there was a image of a martini on the promotion. Ouch. On top of the misleading visual, there was no expiration date or website.

They sold four. Someone needed a martini after this clunker (sorry folks, please scroll past the white space to see the deal and the rest of the report):

Deals that already have very low prices - such as half off a five dollar drink, not only will not sell a lot, they also generate lower total dollars, in comparison, say to a travel package that may only sell a few packages but has a high price point. Put another way, if a deal program tries to sell a $5 item for $2 - in an online credit card transaction - the deal better have everythingelse right going for it - no restrictions, multiple locations, good visuals, right target audience and so on. Or you've got a dirty deal on your hands.

Street Leathers of Oregon ran another epic flop by being too chincey with the customer. The deal offered $5 for $10 off of just one product on the store: Head wraps. Even if this deal wasn't restricted, $5 for $10 is probably too low to be enticing to people who buy street leathers, which have a much higher price point. In short, it's really would not be a 50% off offer at all but more like a 5% discount.

This scintillating offer sold one.

You could also point out that the visuals on this deal aren't great. Like an ad, deals need great images and headlines that match and convey the message. In this case, the logo up top is not as good as a descriptive headline and the image - broad interior shot of the store - could have been replaced by a hot leather-clad model, wearing the thing that is marked down. Keep your street cred for your deals program by making sure deals are really, really offering value and that the headline and image do a good job of portraying the deal.

3. The bowling deal that busted

Another example of a low-dollar deal that went bust was 50% off bowling. Why, you ask, wouldn't 50% off be a strike or at least a spare? When it's Fridays only, has no expiration date, and does not apply to food and drink. Make low cost deals enticing by including more, rather than less. Also the visual was mediocre.

4. The kitchen sink that sunk

The Somerville Showroom has beautiful high end kitchen and bath appliances for homeowners remodeling houses. The first deal program this merchant ran didn't go down the drain but was, simply lukewarm. The company offered $40 for $100 worth of products, and sold 36 certificates. Barely enough to pay for a low flush recepticle.

If you are noticing a pattern here, it is that this merchant was also probably reluctant to discount too much, and did not discount enough. Nothing in the showroom was anywhere close to $100, so the deal became an insignificant discount.

Fortunately for this merchant, there was a happy end to the story. They tried again with a better offer: $200 for $400. This increase in value did the trick. Sales rose to 104. Perhaps because more serious customers (with $200 to spend) attracted to the deal, the merchant walked away with a $50,000 remodel. So sometimes a better discount gains higher revenues. $500 for $1000 anyone?

Having closed these four flops with a happy ending, let's review lessons from epic fails from companies who, in general, have good deal programs:

*Price is too low, relative to the value.

*Offers are also restricted to a "one off" or particular date

*Images misleading or not enticing, headlines not on point

An overall point here: The sales rep or deal tzar caved into what the merchant was wiling to do. So if too many deals are failing, there are really only three reasons:

a. The market/sales organization is not controling the deals. This could be, in part, because of running too many deals for your infrastructure or market. So if you are in a small market, consider reducing the numer and going after quality.

b. The promotional list/effort is not big enough to sustain your deals, even the good ones.

c. The deals are not good enough. Back to reason number one.

One way to fix your program reduce the number of deals and focus on quality - and on ramping up the email list and marketing. Of these, emails is the most important, accounting for 80% of trackable deal responses. See How to grow a huge email list,. You can also try buying pre-opted in emails from Take5Solutions, and use these Megacontests for Facebook also build email.

Make sure that reporting email growth is part of weekly and month over month numbers that you look at. Aim for month over month, not month over same month last year. You need growth! Most local media companies are nowhere near the market share of emails you need to have, so look at 80% of your population (the % that has email) and pick a big target to own and a promotional plan that matches. If you marketing person cannot or will not build these lists, a new position - or change in positions if you are a small company - may be required.

To underscore the importance of the email list, take a look at the Tale of Two Cities from SecondStreet (the green line is the successful city, blue line is the stalled market).

Thus, you can see the that a main reason deals stall out is the email list. Resources on email growth also show that there is a vicious circle if the deals are not good enough - good deals drive email growth, email growth creates better deals. You need to excell at both!

The most tried and true way to control deal quality is to hire a dedicated rep and vet deals in a formal process.

According to Second Street Media, almost all of their top media partners have a dedicated rep. The second common trait is having a deal committee to ensure deals are priced correctly, ie appropriate to the price of the average sale, not too restrictive, either by products included or time framework, in the right category, and finally, something they would recommend to a friend or family member.

So if you go without a dedicated deal rep, make your deal weekly and keep the deal committee. That way, a lone deal tzar, often the sales manager, is not left saying "no" to clients without a supportive group.

Avoid lame categories

Another way to maximize revenues is to look strategically at the categories that good deals are coming from - and where they are not. Keeping on the theme of looking at the worst case scenarios here, deals you want to avoid fall into the following categories: Dental and Chiropractors, jewelry, fitness and photography. We're not saying these never work, but if you are trying to turn around your deal program, stick with the winners:

Add focus winning categories

Let's look again at categories that are winners - even if your program is on track - and optimize the deal schedule and sales to take advantage of what you already know about categories that do best based on Second Street Media's data across markets. This is equally true if the company is smaller and chooses to run weekly deals as it is if the local media is larger, and runs deals 365 days a year. Part of the strategy is optimizing the allocation of deals in the top categories, so that there is a good variety of potential top deals, and a strategic focus to get them.

Considering the category

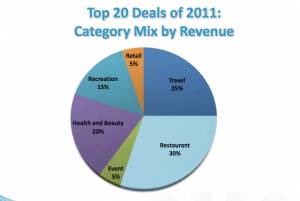

First, let's look overall at categories of the 20 top deals in each market compiled by Second Street media, below, compared to a typical distribution of deals in the chart just below it, for one local media company. By creating a pie chart of your deal revenues by category and comparing it to this mix, you will learn what deals could to be beefed up.

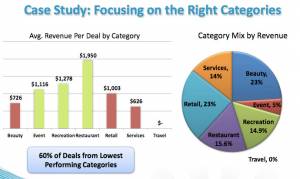

Let's look at a typical, moderately successful deal program. By comparing the average rev/deal/category to the number of deals sold in each, it's easier to see which categories deserve more focus, while still maintaining a variety of offers. Below is an example of a company in which 60% of the deals were sold in the lowest performing categories. Simply by switching the 60/40 to 40/60, this company could optimize its returns. Here is its existing mix:

Now take a look at the Top 20 deals by category by revenues from companies using the Second Street platform, below. Given this information, the above company would want to look at shifting deal acquisition targets from services to Travel and restaurants to maximize revenues.

Travel deals are usually few and far between, but the top one or two deals are often travel deals - very significant ones, with higher price points, not as many sold. Find more travel deals, the most successful. Another way to increase revenues from deals is to time them seasonally: People buy dirt for their gardens in April, but not in June. Men's shirts sell well in November before the holidays, and before Father's Day, but not at other times. Here's a quick calendar to map deals around:

Finally, have great deal promotions

Use your assets to promote deals. And increasing number of companies are using traditional media to promote deals in sytematic ways. Broadcast anchors can mention big deals on air driivng immediate traffic - especially to day-parted audiences for specific deals. Print companies are now running large ads for weekly deals, or a page of deals, to cross-promote. This also helps differentiate the program and win better deals from your competitors who don't do these promotions. For a great example of a promotional push, in which publishers appear in ads to 'back-up' each deal, take a look at ShawMedia's example.

Conclusion

If your deal program struggling create an assessment that moves through a diagnostic funnel:

*Market size is large enough to sustain the number of deals offered. If not, look at scaling back and focusing on a weekly deal, and/or infilling with seasonal deal stores.

*Right leadership. This includes a dedicated rep or responsible specialist, deals committee and top level evangelist for the program.

*Big enough marketing list. Often marketing, not sales, controls the most important element of deals programs... the email list. make sure your paln to grow these lists have double, triple and quadriple targets aimed at market share, not just incremental ones. Local media are so far behind companies like Groupon and Living Social in email acquisition that only bold moves now are appropriate. See case studies on how to grow a huge email list and using facebook contest to drive amail.

*Deal committee. Have your three top people, the Tzar, rep and program manager vet deals and train the sales team on your standards.

*Promote all the time. A real promotional plan includes legacy media, and a standing ad on all site pages - even a position in the nav bar is not a bad idea. Use your assets!

Many thanks to Matt Chaney of Second Street Media for sharing his expertise with us.