The "Best versus the Rest" in radio: What top digital sellers do right

Why do the "best versus the rest" local radio stations have 7 to 10 times more digital revenues, market share and digital revenues as a % of total revenues than other radio companies? Below is an outline of fundamental strategies that separate these elite companies from their peers. These fundamentals are taken from Gordon Borrell’s presentation at Radio Ink Convergence, 2012 and the Benchmarking: Local radio station's online revenues, January 2012 report created for Artibtron, Inc. by Borrell Associates. It includes five actionable strategic approaches that are game changers.

Radio has fallen behind other media - except for a few stations and groups

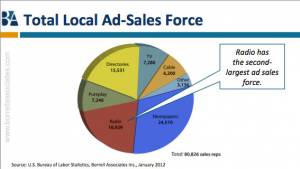

Radio stations have fallen behind television, newspapers, directories and pureplay companies in selling digital products. With the second largest local sales force, radio has acquired just 1.8% of the local digital advertising pie.

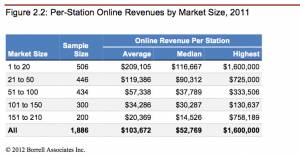

While digital revenue growth for the average station is projected at 35% in 2012, it is a fairly insubstantial number in total dollars per station. At the low end, radio sells zero to $10,000 in digital revenues, while most fall anywhere from $20,000 to $200,000 and 3/4 of local stations bill less than $500,000.

A few stations and clusters, however, have been more successful, selling 7x to 10x the digital revenues of their peers in similar markets, with an elite group of stations topping $1 million, or $700,000 in smaller markets.

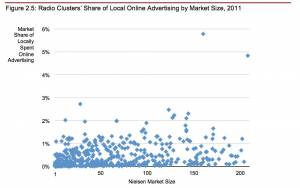

Notice in these statistics (above) that there are successful digital sellers are in both large - 1 to 50 - and small - 151 to 210 - markets. These high achievers are also able to acquire many times the market share of their peers. From Borrell:

"The average radio cluster received just 0.28% of all locally spent Internet advertising... Averages for TV stations tend to be in the 2% to 5% range, and for newspapers in the 7% to 15% range. In our database of more than 5,300 media companies, none achieved more than a 28% share of all online advertising in its market last year—an indication of how competitive and niched-out the local Internet space can be."

The highest radio cluster in the small market range was able to take 5.78% out of its market's digital revenues - a significant number - compared to a median of .34% for the rest of it's radio station peers.

So what do these top digital sellers do right to gain bigger footholds in a competitive marketplace?

Core strategies

1. Add at least one digital seller; and often an online sales team to compliment multi-media teams

Most super performers have expanded form just one digital seller to a full online sales team. However, just one digital seller/specialist typically doubles the legacy team's digital sales.

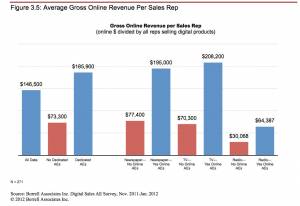

The number one actionable strategic initiative that most stations can use to acquire significant growth is to add a digital seller. The average local media's digital revenues per rep were $73,000 with no dedicated rep, but $185,000 with at least one digital seller. Radio stations with one seller also more than double revenues per rep from $30,068 to $64,387.

Super performers have expanded an online sales team. Just one digital seller/specialist typically doubles the entire team's digital sales.

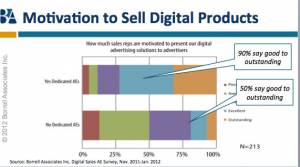

Digital sellers also have a big impact on culture; in organizations with at least 1 digital sales rep, 90% of reps say they are motivated to sell digital versus 50% in markets without one.

With a specialist radio advertising should be 10% of the total gross from digital. That’s a number now typical with many print companies. McClatchey is at 45%.

2. Train, compensate and organize around multi-media

Training and organizing around digital (compensation of reps, digital sales management) not only supports digital sellers but also leverages the whole sales force by making them digital ready. Most radio stations are way behind in this area, compared to television and newspaper companies. To give an overview of digital-ready teams, radio has 2/3 the reps in the market, but only 1/5 of the digital ready reps. It is, in fact, badly "outnumbered" in the market when businesses are increasingly interested in acquiring leads via digital products.

"The Best" digital selling companies have invested in larger digital sales staff and overall training according to Borrell:

In all but one case, they are part of a network of stations whose corporate ownership has applied additional resources to its digital initiatives. These resources tend to focus on sales management and sales training rather than technology and content.

3. Focus on market share goals.

This is not only a key Borrell recommendation but is also a best practice of print companies with the highest market share (typically 10%). They all begin with big targets, and top down driving growth of digital revenues and audiences.

"Don’t compare your station to other radio stations – that’s being the prettiest of the ugliest sisters."

For companies just getting started, " .1 is achievable .15 is good," Borrell says. Top companies are in the 6 to 7% range. Here is the breakdown, with percentage market share on the vertical (0 to 6%) , and market size on the horizontal (top 1 to 200 markets)

Focusing on market share opens the door to look at the variety of products and services in demand by businesses that currently do not buy radio, provides a new source of leads for upsells and "gets back" customers who dropped to focus on "their website" and "promotions." A good practice is to look at your market from the perspective of the competitor: How big is the opportunity, what are businesses buying? And then ask, how can we leverage our sales force, knowing that adding just one digital seller will double the opportunity overall?

4. Successful product strategies

Since radio stations were not as distrupted by digital competitors early on, they have been less adaptive than print companies in creating digital product strategies - with a few exceptions. The two biggest mistakes that radio station make in creating product strategies, according to Borrell, are "Choosing the shiny new thing" and " thinking of digital brand extention."

Successful product strategies at "The Best" have several things in common:

a. Selling the core digital assets, including banner ads. These are not included as value-adds, but priced separately. (Average CPM's for locally sold banner ads range from $10 overall, to $12 for targeted ads. Site "wall paper" using technology from Impact Engine, can be sold by the day for top dollar - $25 to $50 CPM's or more - to promote sales and events)

b. More audio streaming and paid search advertising than their peers. Search in this case means creating into the directory, and even classifieds or city guide platforms that allow local merchants' own web site to appear higher in the rankings.

According to Borrell, the 22% of online advertising from streaming audio grew 20% in 2010 and is forecasted to double in 2012:

"as more stations see value in their streaming-audio audiences. Even at double, however, the industry’s total streaming-audio commercial revenue will still be half that of its pureplay competitors—namely Pandora and countless independent stations who are also starting to grow local ad sales. Last year, Pandora hired a former newspaper digital executive to head up its efforts to tap local commercial spots."

But streaming in its current form does not present the same opportunity for all stations:

One-fifth or more of the audiences for adult contemporary, pop music, news/talk, and country formats were listening to audio streams online last year, according to Scarborough Research (see Figure 1.5). But the scale drops rapidly after that. For the majority of other formats, more than 90% of the listeners are not listening online.

c. New products that add significant market penetration.

As mentioned a few stations have added classifieds and directories. One station, WCHL-AM in Chapel Hill, N.C., reported in a February interview with Radio Ink that it gets 25% of its total gross revenues from online sales for its stand-alone website, www.chapelboro.com, which is created as a city guide. To launch these broader initiatives requires at least a small separate online team.

Other stations have added targeted sales by teaming up third parties such as Yahoo to create behavioral targeting that expands the premium targeted digital inventory, and have begun streaming video (if newspapers can stream videos, as the above charts show, why not radio?).

Mobile is still in its infancy. A few stations are selling tens of thousands in app and text sponsorships, with one "anomaly" at $100,000. One station has signed 50% of its 12,000 population on text alerts, which it uses both to sell sponsorships and drive traffic.

A variety of new products, services and transactional opportunities are available - especially those which can be best driven by onair campaigns.

LMI observation here: Any sports station or station with a major sports team should consider a sports app; stations in areas with potential weather dangers should consider addding weather apps; as these have been able to secure major sponsorships, up to $6000 a month in some cases, when combined with campaigns.

The few outstanding stations sell many times what their peers are sell in digital products while just tapping the surface of these new revenues streams.. These studies only include advertising. Other possibilities with significant potential include local app stores powered by onair campaigns, multiple Facebook contest sales, a "deal of the week" if a daily deal is not feasible, deal stores, and transactional approaches such as ticket sales.

5. Promote radio’s intrinsic advantages for multi-media marketing.

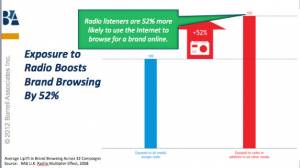

Radio has some great statistics to use in multi-media packages. The marketing person should stay on the look out for how radio pairs with digital. Here are a few to start using, with images below:

*Radio listeners are more connected

*48% more likely to own a device or lap top than tv or newspaper viewers

*Radio listeners are 52% more likely to browse for internat products with exposure to radio.

*Radio listeners may actually be on line while listening, the ”hands on keyboard phenomenon" meaning that they can take immediate action.

Here's a visual image of the "Hands on keyboard" phenomenon, that is people are listening to radio while on the computer or other devices, providing great opportunities for radio to promote deals, apps, and other digital-based initiatives the station or merchants has.

Conclusion

1. Make a financial case for growing online

Readers of this report may already interested in growing digital. But getting others in top management interested may continue to be a challenge. Borrell advises executives to make the financial case for spending more on digital, so that the whole team gets behind this as an investment “and not a a cool thing.”

The most powerful statistics in this report to help make the case include:

a. The additional revenues in digital from adding even one digital specialist

b. Looking at the size of the pie by looking up your market's total local digital dollars here. Calculate the difference between .1 percent of the online digital dollars and your market's current digital share. Then calculate the total dollars gained at another .05% of market share. At 6% where the top radio companies are now.

2. Add a digital rep or specialist

While some companies allow digital teams to compete and keep them separate, there are some simple ways to hire a digtal rep or team without having them compete. One simple way is to protect any account that is already sold or has a scheduled selling appointment, and to bonus the specialist for helping reps upsell their own accounts to digital. Keep in mind that you can't take the bonus out of the legacy rep's commission or that will create a disincentive. However, you can create bonuses throughout the company tied to digital sales - for reps, that could be that the digital goal must be met for the overall bonus to kick in. For managers, a version of the same. For top manager, we've seen 25% of very significant MBO's tied to digital goals at the manager, president and COO level.

3. Our take

Cultural change is, perhaps, the biggest obstacle to radio stations transformation, starting at the top. The challenge is two-fold:

a. The innovator's dilemna. That is that the legacy product remains temporarily healthy, though in long term decline, selling a premium product. The digital markets are typically percieved as difficult or even "bottom feeders" selling to less than "ideal" customers at lower prices. So there are an number of "concessions" of those areas of the market - until the disruptive business moves upstream, gains the premium customers, and catching up becomes impossible. (Find a more complete explanation of the innovator's dilemna here).

As many at RadioInk Convergence have pointed out, the media industry needs to learn to fail. Fast, and cheap, but confidently. It's all part of the learning curve. Four failures behind you is four failures ahead of someone else.

Change must be driven from top down by executives who see themselves as running digital companies and who are fully aware of the innovators dilemna, its pitfalls and strategies to avoid it.

b. Sellers are not inspired to become media consultants. Today most radio sellers have no incentive, or even adequate training, to move from high-end, "push one product sales" to more complex, solutions, that involve multiple, often lower-end products that deliver measurable results for merchants.

Adding a suite of new products requires training, support, and new compensation plans. But it also requires that sellers ask a different set of questions. That is why digital sellers are so important in the mix. A few home runs - for example selling contests on digital platforms, or a weekly deal - also help teams to "decide" to become multi-media reps. But top companies are no longer tolerating hold-outs, they either hire separate digital teams, or require reps become mult-media sellers with the help of specialists, or in the best cases, both. And that means training, and support.

c. Third party technology partners are the new allies

Executives should spend some time getting to know third party technology partners who can help them achieve their goals. Technology partners allow media to provide a number of services that would otherwise not be possible. A top recommendation is to spend more time getting to know vendors.

Many thanks to Gordon Borrell, of Borrell Associates, for sharing his presentation at RadioInk Convergence and study for Arbitron.com. See the full benchmarking study on the home page of Arbitron.com.