Confronting disruption: Three key local media strategies from Clay Christensen

"The Innovator's Dilemma" author applies the theory to local media trends

Watching Clay Christensen speak at Borrell Local Interactive Conference several years agao was especially moving as he had recently recovered from a stroke which required him to relearn speech, word by word. His presence ws also, perhaps, an appropriate metaphor for an industry that is - sometimes painfully, sometimes exuberantly - relearning each of its marketplaces from the ground-up. Below is a summary of his talk, stil relevant today. His comments are italicized.

Clay Christensen begins his book, "The Innovator's Dilemma" and his conference presentations with the big question: Why is it that the smart people in leading companies nearly always fail to take advantage of disruptive technology, even when they had it first? He argues that the same good business practices - optimizing the business for current customers and maximizing margins - that originally led to success, eventually cause companies to fail.

The only good news, it sometimes seems, is that we (in established media) are not as dumb as we look.

However there are huge overlooked opportunities available in the local media space. As Christensen put, market leaders "don't understand how big that market of non-consumption can be."

He suggests that training management team to understand the process from a thousand foot view will help them tackle new markets in ways that ultimately work.

So here's a brief summary of his theory, with our observations on how this has played out (in italics) in the local media space, and three of his key recommendations for established companies.

Essentially, technological disruption, studied over a variety of industry charts a remarkaby consistent course, whether in steel, auto, cell phones or local media:

1. The new technology is identified first by industry leaders...who fail to act because it does not fit their business model The principle issue is over preservation of high margin accounts and the need to listen to current customers not new markets, but is also more complicated as we will see below).

Christensen's leading example is big steel, which neglected to get into the mini-mill business until it consumed most of the U.S. market. BTW, using examples from other industries is helpful in teaching this theory, since people are less defensive.

2. Start-ups, often led by disaffected traditional executives convinced of the possibilities new technology, look for new markets to go after. In steel, the mini-mills, small units that reconstituted scrap metal, took on the rebar market and other uses underserved and unwanted by large companies.

In the media industry, this was easy to see occurring: The head of Groupon had ideas shot down by corporate media before moving on, similarily the CEO of AutoTrader.co (see case study here) survived culture wars at the LA Times, before insisting on a separate internet division at Cox.

3. Big industry concedes the "new" market to the the upstarts, because there is, initially, little ovelap. Not to worry, there's no real money in the internet. Once we've recovered from the loss of classifieds, revenues will even out. In the radio industry, we see the almost paralyzed response to Pandora is due to the general stability of radio revenues overall...for now (see case study on Pandora here).

4. Competition, financial pressure and ambition push new companies "up-market." The advantages gained in organizing a business around the new technology, share of new markets and accumulated knowledge base, make it difficult, then impossible, for the established industry to catch up. In the steel industry that meant the new, improved mini-mills began producing sheet metal.

In local media, that meant the loss of classifieds would be followed by the loss of other key verticals. ReachLocal began as a pureplay Google AdWords reseller, a model whose margins were too low to attract most traditional media. ReachLocal thus gained not only accounts interested in AdWords, but also developed a crack sales force expert in the new model of selling ROI, instead of products. Today the media agnostic team, has has moved beyond AdWords, to an increasing variety of ROI based marketing. Similarily Google and Facebook have rumored plans to launch huge feet on the street sales forces. And, finally, Autotrader.com, starting from scratch by offering free online used auto ads, is now going after new car dealers. Started in 1999, the online-only division will top $1 billion this year.

Back to radio...Pandora is now selling local advertising over the phone, starting with call-ins. Soon, however, they began testing feet on the street to cover large regional advertisers.

5. As industry leaders cut costs and push into the new markets, there is a slight bump in revenues and profits, referred to at the "Dead Cat Bounce" followed by steep, ongoing decline. This blip on the excel spreadsheet is follow by rapid and perpetual decline of the established industry.

Experts speculate whether and wehn local media is in this is the period, which may last for a year, followed by a five year drop-off of revenues and take down many local media companies in the process.

There is some good news for established media, however, as well as for start-ups hoping to disrupt them. Christensen gives these three basic strategies:

1. Established media should create separate business units for digital revenues

Those who follow the local media space (or spent time with Borrell's consultants) have heard this before: In every case in the Harvard business study, the few companies that survived (one in ten) did so by by setting up a completely separate business unit and "giving it a charter to kill the parent." IBM's successful move from mainframe to PC market was done by a separate unit, Christensen points out.

The key reasons for this are as follows:

a. Low margins and cannibalization means that great managers back away from fully supporting the new efforts. The unit has to be compose of people who" wake up every day" trying to get more market share from the new model.

b. Start-up costs mean the initial business is low margin, and not exciting to legacy managers and sales people.

c. The entire "value chain" in the company - including policies, values, compensation, reporting, etc. - in short all of the best practices accumulated over the years - support the old model and thwart the new one.

Autotrader is the only company in the country we know of given full leeway to kill the established brand, and it did, to become a billion dollar leader on its own. As Christensen puts it, "Businesses evolve, business units don't."

Other successful media companies are also taking a three-tiered approach, leaving legacy media in tact with and expanded product suite for hybrid seller, but also developing separate business units and reporting. A full discussion of this approach at Deseret Media, whose digital revenues will surpass legacy revenues this year, is here.

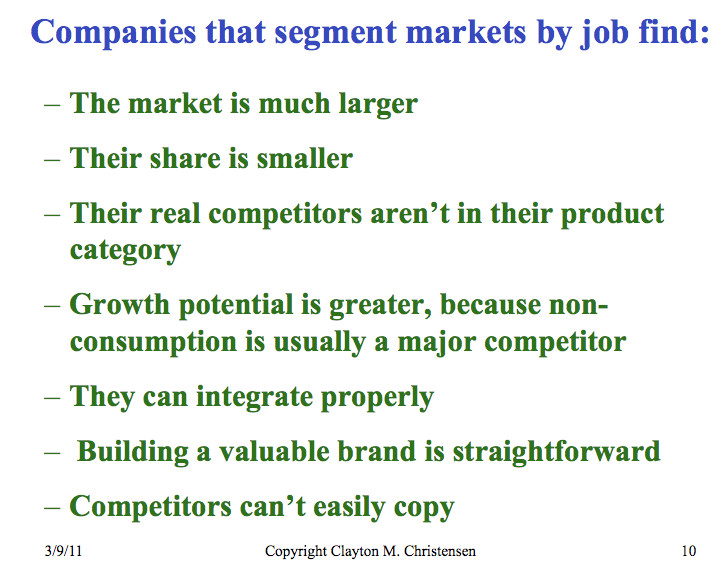

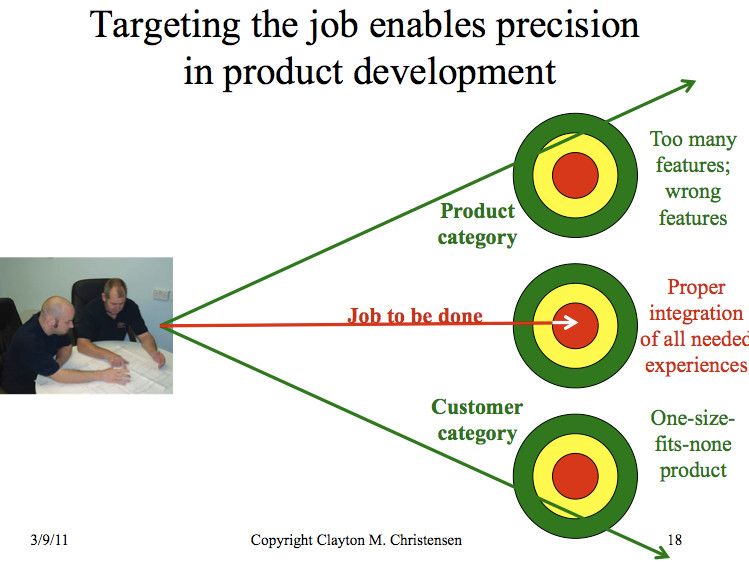

2. Think in terms of - and research - "jobs to do," not target demographics or product lines. Most customers are not buying for the reasons businesses think they are. So targeting either an audience or advertisers without full understanding why they buy and what the unmet needs are almost always misses the mark. In Christensen's words "The customer rarely buys what the business thinks it is selling him."

"We structure the customer by product, and structure the products. But if you are the customer, stuff just happens to you. We hire products to do the job. Understanding the job is the critical unit of analysis...not the customer."

His classic example is the milkshake sales at a local fast food store, which peak during the morning drive time. Focus group research (and you have to picture some Harvard graduate students interviewing people on the way to work, milk shake in hand, to appreciate this) how, to consumers, the "job" of the milk shake is actually to a.kill time in the car, b.fit into a cupholder, c.be consumed with one hand, d.leave no crumbs and e.keep the consumer full till lunch. Not neccesarily intuitive information, but information that can inform product development.

The "jobs to fill" model is an especially useful way of looking at innovation - one learned by most of the top local media executives today. Autotrader's approach also used intensive research on how people buy cars included qualitative focus groups, and statistical surveys that further tested intuitive hunches and focus group results. This process was repeated as the marketplace developed, providing both acccumulated technology and internal understanding that made it difficult, if not impossible, for other media to catch up. Cars.com, the newspaper owned division, is reportedly still about 25% behind AutoTrader.com, even though powered by extensive print and online megabrands.

3. The best way for established companies to take on disruptive changes is to train key managment in how this process works.

Christensen noted that rather than telling executives at Intel, who hired him, what to do, he trained them "how to think" about how disruption works. This led them to make better decisions on their own, launching separate business units with support from key managers. "They came up with this on their own."

Questions from the room during the Christensen's presentation included this one: How can investment in new business models be successful, given the 100 to one failure rate of new entrepreneurial ventures?

Christensen contends, "if the target is to fit in a product or audience, the survival rate is 10%." But if the target is a "job to do" the success rate is 60%.

"The causal mechanism is that we have a job to be done. If you think of the world in that way, you are harnessing the causal mechanism, and if, on top of that, you don't go into head-on competition, then the probability that the established leaders won't come after you is very high, given that they will always focus investments in the most profitable strategies and where the returns are highest."

"You want the competitor to flee, rather than fight."

Many thanks to Borrell & Associates for sharing Christensen, live, with us.