Ten strategies from Autotrader.com

Case study

Company: AutoTrader.com

Founded: 1998

Owners: Cox Enterprises, Providence Equity Partners and Kleiner Perkins

Site traffic: 16 million monthly unique visitors

Key executive: Chip Perry, CEO

Summary: People, who first saw broadcast TV ads for AutoTrader.com, or sold ads to dealerships suddenly obsessed with ROI, probably didn't know that AutoTrader.com was quietly evolving from a newsprint brand to a billion dollar Internet Company. The history of AutoTrader is the unique case of a media company launching a successful pureplay that cannibalized the print product and disrupted a national vertical.

Challenge: By 1998, the automotive publishing industry was beginning to respond to the threat - and opportunity - provided by the internet. Cox-owned Trader Publications included two successful automotive shoppers, one free and one purchased at local convenience stores, as well as a site called TraderOnline. To jumpstart the new space, Cox hired Chip Perry as CEO of the new automotive internet division. A veteran of LA Times new-media/old-media culture wars, Perry's criteria for taking the job was that the new division would operate independently of the traditional media product (a strategy advocated by Clay Christensen, author of the Innovator's Dilemma.)

The internet was already causing anxiety; pundits at the time predicted that soon most cars would be bought and sold online. But Perry’s initial research told a different story.

Yes, the internet was beginning to have a major impact on car purchases: 30% of buyers said they were researching their car purchase online (today the number is 70 to 80%). However, people were not interested in direct online purchasing. One clue to what buyers wanted was how they responded to the new internet auto listings: 78% of respondents used the phone and only 22% used e-mail (a ratio which has stayed largely in place to this day).

Buyers wanted human contact at the end of the sales funnel; but they also wanted to compare cars online first. So Perry's team needed to create a site that understood this behavior.

Strategy:

1. Separate the division. Considered radical in 1998, and still difficult to accomplish today, Cox executives Dennis Barry and David Easterly, decided to allow the new business to operate as a pureplay, separate from the print company (the only shared asset is the name and the ownership), even if it cannibalized print sales. In fact, it was expected to. The vulnerability of classifieds to the internet was already apparent; the company was better off competing with itself to retain transitioning revenue.

"This is not to say this should be done in every space, but it happened to work in our category," Perry says. (News-based media, run by "separate-or-perish" advocates still leverage the brand and the sales team, while building new business units).

"We weren't entrepreneurs, we were radical insurgents," says Perry. Harvard Business School educated, Perry started out at Cox "as the CEO of one person, un-named company in a single office”. The plan was to build the MLS of the automobile business. The path followed several key strategies:

2. Leverage the brand. One of the earliest decisions by Cox was to leverage the AutoTrader brand by giving the new company the pure URL, AutoTrader.com. It was the only part of the print company that was utilized, but may have been critical to its "recall" rate with years of heavy advertising helping. 80% of AutoTrader.com shoppers now type the name directly into the browser.

3. Identify unmet needs: Help buyers by expanding their choices of cars for sale This goal seems obvious, but most media tend to target audiences or advertisers, rather than the specific "job to do" or “problem to solve.” Perry's team decided that a better marketplace for car shoppers had to be comprehensive - the more comprehensive marketplace, the better the consumer's deal. That meant the marketplace initially needed to be free.

To give an idea of the scope of the opportunity, newspapers which charged for listings, only carried 3% of used automobiles for sale at the time

"By 2000, we had 20 to one the number of automotive ads as the newspaper. At that point we knew we had a big advantage as long as we kept growing our traffic for our sellers,” Perry says.

Their ultimate goal was to create a marketplace with the most buyers and the most sellers – once a site reaches this critical mass position competitors must find a way of bringing more sellers to buyers, which isn’t easy, or more buyers to sellers, which is a similar challenge. Academics have a term for this – the so-called “network effects” which means that a marketplace like AutoTrader.com’s has more and more momentum as more buyers and sellers are added to the network.

4. Add photos and rich descriptions, car by car. Another advantage online is the ability to provide more information than before without space limitations. Initially every car had a photo and a full description, and used car dealers could post and remove their listings and photos as they were sold (today, photos are included in the tiered listings, but about ten percent of the listings are without photos and run free, still contributing to the comprehensiveness of the marketplace).

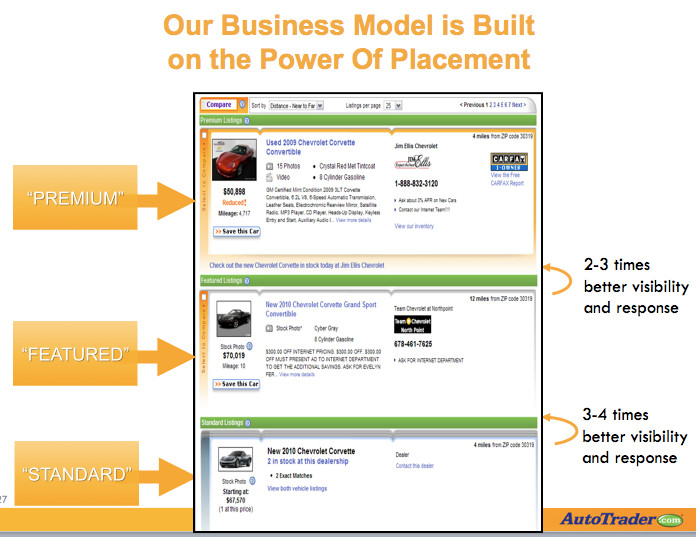

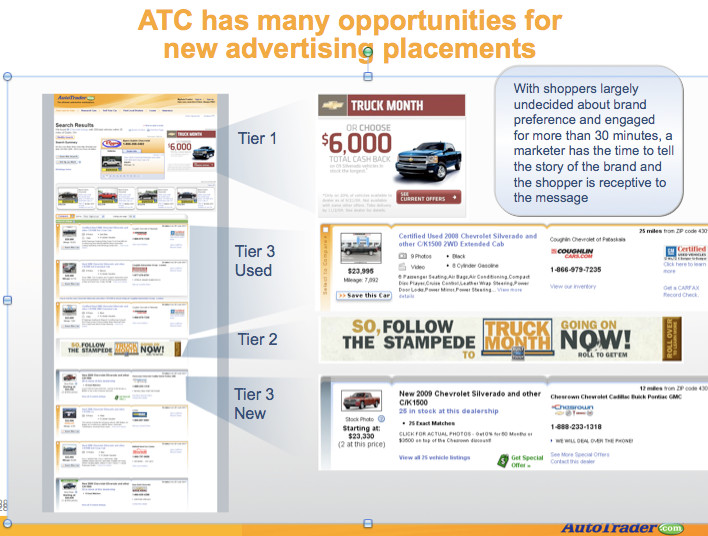

5. Pay for placement model, focus on data ROI The company’s original revenue stream came from dealers paying for links to their websites inside their free listings. In 1999 AutoTrader.com’s business model made a big leap forward when they created a separate tier of listings at the top of the search results comprised of a few paying dealers, who began to receive ten times more visibility and response than the free listings in the lower tier. Response rates were tracked from click-through and call-tracking numbers, and quickly incorporated into sales presentations.

Eventually, a third tier of placement was added, each carefully tracked so the impact of moving up a tier could be calculated into the new ROI and explained to new and current customers (examples in images to the right).

New products and placements evolved model progressed: Display ads on the site, rich media, and most recently, spotlight ads, which allow dealers to show videos of individual cars inside profile pages.

One job for sales representatives is to show their dealer its performance relative to dealers and how to improve performance. This practice increased the dealer’s ROI by spreading best practices and made it more difficult for competitors.

6. Pricing well below established media. The original pricing in 1999, when the internet was new, was just $99 a month for a dealer to upgrade its entire inventory of vehicle listings.

Car dealers were especially knowledgeable about ROI, including the cost spent per car sold, as anyone who has sold into a car dealer knows. With a dealer-calculated average of $400-500 spent on advertising per car sold, the ROI generated by AutoTrader.com’s marketplace beat the old model several times over almost immediately.

"Car dealers were not going to pay a top price comparable to traditional media anyway because the internet was unproven," Perry says.

"We were willing to price lower and work our way up as we proved our value to the dealer," what he calls a "trailing monetization of value."

Today the average dealer pays about $2500 a month to get their entire inventory online for 30 days, still not a lot compared to a television schedule (Perry points out that prices for a premium television spot in the company's Atlanta home base can run $1000 or more).

7. Building an independent sales force. When tests with a local used car dealer showed response rates were not just two or three times better than the company’s early free listings, as hoped for, but fully ten times better, Perry began hiring a sales force. Trained carefully to use site performance data to help car dealers raise ROI, the sales force now totals more than 80 sales people in the top 200 markets.

8. Massive offline advertising campaigns. "Our first TV ad in the 2000 Super Bowl was a guy standing in front of a white background with his hands out, saying 'I need a car.'"

The key to the campaign was promoting not just a better way to buy a car, but "the best way." Since then AutoTrader.com has spent roughly $750 million in mostly offline media campaigns, primarily on broadcast, to hammer home its value proposition. The 70 to 80% of online traffic coming from people, who type AutoTrader directly into the browsers, rather than search, attests to the impact of these massive campaigns.

9. Innovating - and moving up market. One of AutoTrader.com's strengths was its early start and ability to improve its marketplace by studying "jobs to do" and “problems to solve.” Perry calls it “identifying unmet needs in the car shopping and advertising process.”

"We kept making it harder and harder to copy," Perry says. Innovations included allowing consumers to scroll through photographs of other similar cars on a particular lot without leaving the profile, providing more of a "scan and compare" experience.

They also discovered that the average person shopping for a new or used cars looks at both, although online sites forced them to jump in and out of silos to compare them. Today the consumer can walk through all the used and new cars on a dealer lot without jumping to a profile page. The IT team, totaling more than 500 people, works out these challenges and provides a growing barrier to entry.

The innovation to enable consumers to simultaneously view and comparison shop new and used cars in a single search (launched in 2005) enabled AutoTrader.com to attract roughly $100 million per year from auto manufacturers and regional dealer associations. More than 30 percent of the site’s 16 million monthly visitors are now interested in buying a new car.

10. Key acquisition: Kelly Blue Book. The most important acquisition for AutoTrader.com may be Kelly Blue Book (kbb.com), which not only came with a significant revenue stream but also the ability to fulfill a "new job" for people who want to trade-in cars. While 80% of people research the value of their used car online, they were unsure if the dealers are giving them a fair price, or taking advantage of an unequal situation.

Soon, auto consumers will be able to go to KKB.com to get an estimate of their car's trade in value that is guaranteed by AutoTrader. The consumer simply takes the quote to the dealer, who has pre-agreed to honor it. This service, called Trade-In Marketplace, is available on AutoTrader.com after a rapid nationwide roll-out last year.

Results:

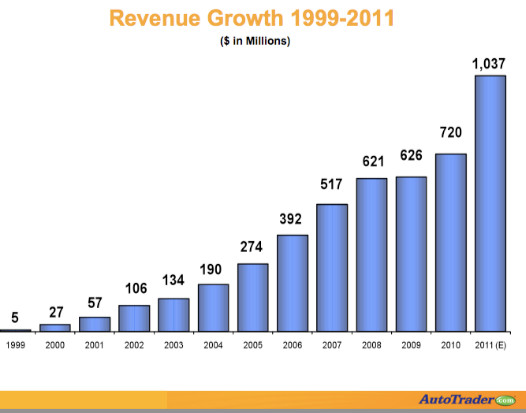

•AutoTrader.com has grown from $1 million in revenues in 1998 to $720 million in 2010, and with the acquisition of Kelly Blue Book and two other companies it will top $1 billion in 2011.

•The company now has more than 3 million auto listings, about 2/3 of the total number of U.S cars for sale and about 25% to 30% more than its closest competitor, newspaper-backed rival, Cars.com. The average car shopper spends an hour on the site every month.

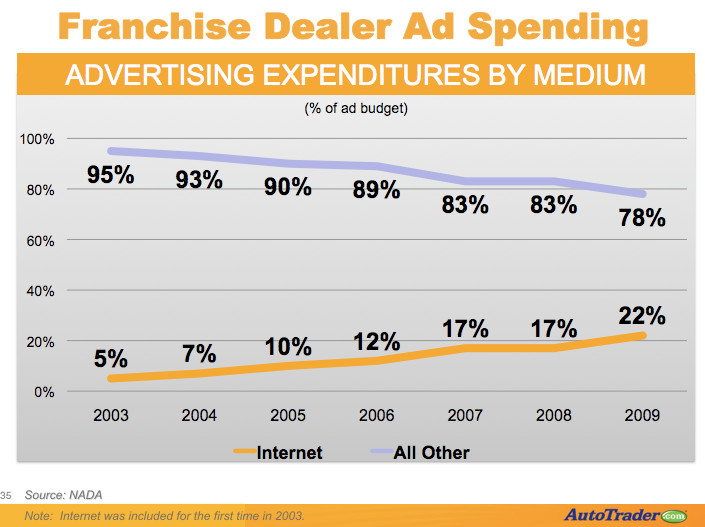

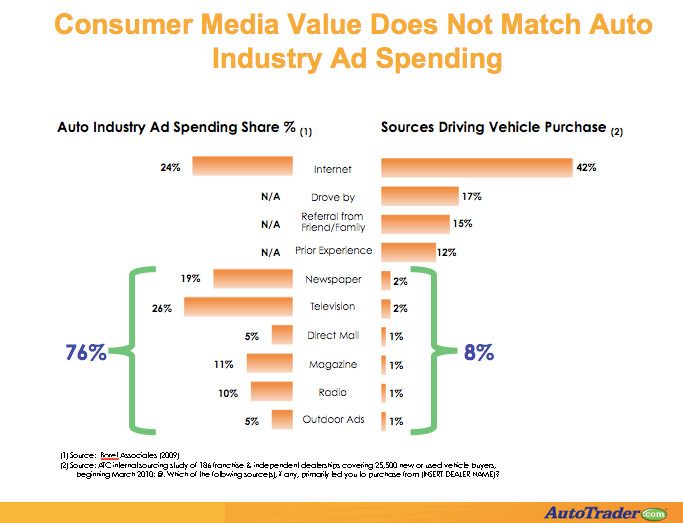

•While the internet now drives 42% of auto sales, dealers still spend 78% of their advertising with traditional media, what Perry calls a "screaming opportunity" for his company's growth in the years ahead.

•AutoTrader publications, fully cannibalized by the start-up, were ultimately shutdown by Cox in early 2009. The companies had operated so separately that Perry says he didn't find out until just before it happened and "over the years I had very few meetings with the folks on the print side.”

•Of the 1800 U.S. newspapers he competed with over the years, Perry says, "Not one reared back on its haunches and said 'Not in our town. Go someplace else, not here.'" Creating comprehensive listings was "the critical litmus test if a newspaper was going to fight us off. And fortunately for us, no one did."

•AutoTrader.com says it still has the only unified database of new and used cars on the internet.

Lessons learned

•"The talent of our top team was critical; we had to grow and evolve across multiple dimensions simultaneously, constantly looking for unmet needs and how we could fill a gap in the market."

•The company "had to be independently driven to find its own value proposition." And Cox was "willing to cannibalize what was a profitable, successful company because they saw a bigger opportunity. That took a lot of vision and fortitude by the top people at Cox."

•The central question any local media company has is "what are the needs that people have in our town for information products and services? There is so much pursuit of revenue that it is not about what problems consumers have in their lives and how to reach those customers..."

Perry's team succeeded, in part, because they were crystal clear about the problem. "We help consumers save time and find cars they never would have found and deals they never would have gotten because they were empowered by information. At the same time we help advertisers reach car buyers much more efficiently than traditional media.”

• Perry's team used intuitive hunches, vetted by focus groups and checked by statistical data to make sure they got right what people wanted in a car shopping experience, and what car dealers would be willing to pay for online advertising. “It was a very iterative and research based experimental process“, Perry says.

•For many years we've been highly focused on helping advertisers improve their performance online, and very analytical in training our reps to help dealers succeed. ... We look at the top of the list to see who's doing the best. We study them. And we train the whole industry on the best practices of the top performers, who are easily visible on our web site."

The author, Alisa Cromer is publisher of a variety of online media, including LocalMediaInsider and MediaExecsTech, developed while on a fellowship with the Reynolds Journalism Institute and which has evolved into a leading marketing company for media technology start-ups. In 2017 she founded Worldstir.com, an online magazine, to showcases perspectives from around the world on new topic each month, translated from and to the top five languages in the world.