New metrics and planning worksheets for 2015

Create clarity by setting targets with advice from Borrell Associates

What metrics should your company be tracking in 2015? Here are a few key numbers with advised by Borrell Associates.

1. Share of the local online ad spend, with one year and five year targets

This is a key practice of top performing companies and key recommendation of Borrell Associates. Look up your total market data for online advertising free from Borrell’s interactive site of ad-spending estimates by region.

Even large media companies find the share is only about 1 to 5% of the total digital ad dollars (the largest share is skimmed off by pureplays). Top performing companies generally took three to five years to achieve a 10-15% market share. So 2015 is a good time to set a three-year goal of 10%. The maximum share for a local media company for any DMA is 28%.

Tracking marketshare encourages companies to break out of incremental thinking and focus on the larger potential.

2. Percentage of overall revenues that comes from digital

Typically the percentage of revenues from digital for most local media companies falls in the range of 5% to 15% of total revenues, but companies such as Hearst’s LocalEdge, YP, Yellow Media and Dex Media are achieving between 35% and 65% of revenues from digital.

Careful to keep these goals as whole numbers, rather than reflecting the decline of the legacy media year after year. But setting this goals to help create direction, plan beyond legacy media and develop new products and services.

3. Sell through rate (STR) for digital display ads

A starting point is to sell your own site, so all local media companies should aim for "100% sell through" of display ad inventory on their sites which is technically achievable through ad networks that monetize remnant space; in fact every impression online and on mobile can be sold.

But for non-remnant local and national sales, 60% STR is a standard first target. Companies that are not at 60% STR should set this as a goal, typically achievable in a one year period.

The new metrics for achieving companies in 2015, however, is sales of targeted buys which have a higher margin. Setting a goal for targeted ads a a percentage will help focus the company on creating targeting capabilities that are in demand by advertisers. Most small media are now using audience extension programs via ad networks to sell more targeted ads. This makes sense since only 19% of newspapers in the United States reach 25% of their city's population via their web site. There is just not enough to "split up" without extension programs

4. CPM ranges

To make sure metrics are solid calculate all the CPM rates. Current local CPMs (outside of remnant ads) on local sites are running $10; $12 for targeted ads; $10 to $15 for mobile; $15 video, and $25 for rich media ads. Factoring in remnant ads should yield an overall rate of $6 to $8 CPM.

Here's a worksheet to make sure you are maximizing yields and sell through.

5. Active ad count month-over-month increases

Ad count is part of determining whether market share is increasing or decliining and informs the culture and objectives. Companies that are growing digital agencies or events divisions are making great inroads into market share.

Showing market share increases requires tracking active ad accounts, total ad counts and churn. If your organization does not keep these numbers, it's time to start, even if you don't backtrack.

A simple start is to track incremental gains in active accounts month-over-month, that is February over January, rather than February 2013 over February 2012.

Set the goals by thinking in terms of x number of new active accounts @rep for reps in growth mode.

This also requires knowning how many active accounts a rep is expected to handle, rather than burdening the top rep with the same number of new sales as a new rep starting without an account list. Test your theories against the top sellers in your teams.

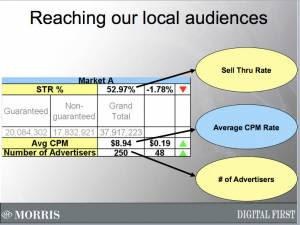

A couple of years ago, the now top performing Morris Publishing Group created a snapshot report (see image to the right and top worksheet) to track three metrics: Sell-through-rate (STR), CPM and ad count. This month over last month worksheet focuses the company on monthly incremental month-to-month growth.

Besides ad count, Morris tracked digital inventory sold, but this could really be any product or service important to the strategy.

What's a good total market share in terms of number of local businesses that a local media should reach through all of its products? The dominant media should "touch" 40 to 50% of local businesses in some way during the year, including classifieds, search and so, according to Borrell.

3. Add events to revenue line items

Non-traditional revenues are increasingly important - so consider adding revenue generating events as a new revenue line item (see the event channel at LocalMediaInsider.com/event for how to do this).

An events line item for revenues is the "first step" for most companies creating events as a new unit. If events are not yet profitable, a good starting goal is to create one significant event that "pays for" the event director's salary in the first six months of 2013. Top management should get involved in helping create and support that event, including mandating compensatory time of for staff that work big events.

4. Email as a percentage of population

E-mail is an increasingly important audience and needs an aggressive target for 2013. Big gains in this area are also achievable with an aggressive calendar of contests and sweepstakes. Email as a separate revenue stream is generating $150,000 to $250,000 in direct sales of email ads in small markets.

Today 50% of population should be the first target, 80% is a three year goal. There are a variety of email platforms that act as targeted buys for extending audiences as well.

5. Revenue per digital sales per sales rep

Average digital dollars per legacy rep was about 5 to 10% across local media countrywide in 2013, and has edged up since then, according to Borrell Associates. Know what this figure is at your company and use it to determine when and if addiitonal digital only sellers are needed.

If legacy reps are under-performing, the first step is to hire a digital specialist, who can support 10 to 15 legacy reps. Studies have shown that just one specialist doubles the digital sales per rep of all reps - radio, print and television all show at least this revenue gain.

The top performing media have five separate digital reps. So if 10% x legacy rep revenues is not enough to power larger market share targets, it's time to add direct digital-only staff.

A start-up digital sales rep should be able to bring in $150,000 to $250,000 in one to two years selling a combination of small, medium and large accounts. Mature digital representatives with annual lead-based sales and low churn, can sell three to four times salary in digital sales, so that a $80,000 to $100,000 representative may have an account list of 80 accounts can bill $400,000 per year.

6. Operating profit margins

"The profit margin in digital media is destined to be similar to radio, where there’s very little cost in product and delivery. Radio’s EBITDA is typically 30% or more, and we fully expect many digital operations to get there as well."

Hope this helps members plan your 2015 budgets. Please feel free to contact us with questions about additional resources for specific areas. The two attached worksheets show how to do a month over month snap shot for the fastest growing revenue streams, and start tracking rolling units for new products, targets and audiences.