How MediaOne of Utah's launched a real estate brokerage

Company: MediaOne of Utah, a JOA between Deseret Media and the Salt Lake Tribune

Brokerage site: UtahMore.com

Traffic: 500,000 page views

Core sites: DeseretNews.com and Tribune.com

Traffic: 50 million Page Views, and UV's 5 million

Key executive: Brent Low, CEO

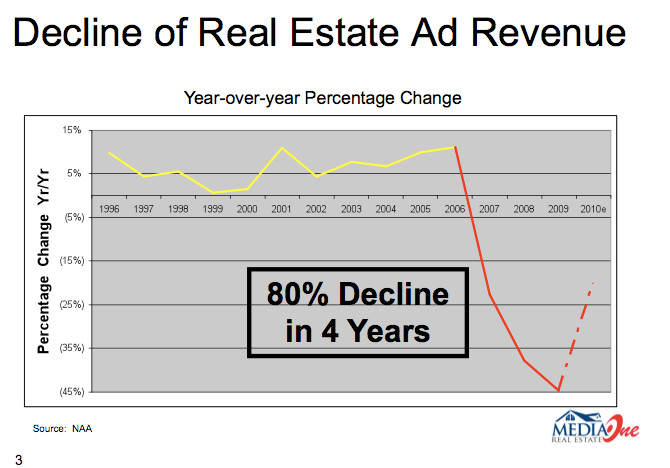

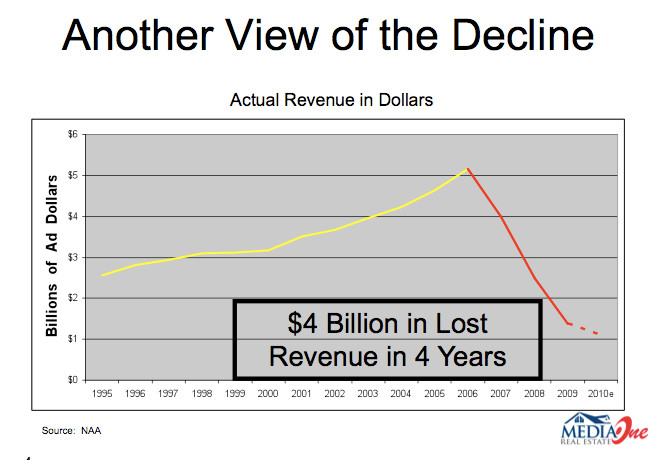

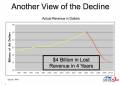

Summary: In the four years that ended with the real estate crash of 2009, $4 billion in real estate advertising revenues vanished (images 2 and 3 to the right). MediaOne of Utah responded by creating an in-house real estate brokerage. Leads are gathered primarily through an MLS bot in the hero position on a new real estate "super- site" UtahMore.com. In it's first year, the company ran with three brokers and 65 contracted agents, who rented desks in the mostly empty classifieds department. Brokerage sales topped $1.6 million in revenues in 2011. In addition, the site boasts another $40,000 a month in new advertising around the vertical.

Challenge: Brent Low, the CEO of MediaOne of Utah, had built a reputation for replacing legacy declines in revenues with multiple new print and direct mail products. In 2009, he came up with a radical idea: To build a brokerage inside the media company, replacing real estate classifieds with direct commissions on property sales.

“Most (print media executives) look at the real estate category and say, if we launch a brokerage we are going to lose all this money. My point is you only lose the broker and agent revenue. Most newspapers have very little of that. You still get private party, new construction, and affiliate advertising from verticals like mortgage and title companies.”

(For those of you wondering about the relationship of DeseretMedia, whose digital division is run as a separate company reporting to Gilbert Clark, and MediaOne of Utah, the JOA: The JOA runs it’s own digital programs that sometimes compete. "The church(-owned site) has a mission. They want voice and I don't know that their brokerage give them a voice. It’s beyond their mission,” Low said. UtahMore.com is a channel on Deseretnews.com, but reports to the JOA’s corporate office.)

Strategy: The management team first vetted the concept of a brokerage against its key criteria for online development. There are several attractive advantages to the brokerage concept:

•Low barriers to entry

•Industry is prone to price disruption

•Low loyalty to a brand, spells “opportunity”

•Variable workforce

•Low start-up costs (no inventory/carrying)

•Marketing to our “audience”

Finally, there was the cost of "doing nothing" as real estate revenues disappeared. In the end, Low concluded a brokerage was “Low risk and fits our business model.” The launch team included members from marketing, digital, finance and the CEO plus two brokers that were hired.

Joining the MLS

Low (who got the idea when he obtained a real state license on the side) says that joining the MLS is not difficult but critical to owning a complete daily feed of searchable listings. Federal law prevents MLS services from picking and choosing between brokers, so MediaOne of Utah – and any media for that matter - cannot be excluded as long as it meets all the other state requirements.

The business plan

The new business required two strategies, one for listings and one for buyers. A key decision was to focus on listings exclusively, with a long term objective of owning the largest share of listings in the market. Key components of the plan included:

• Creating a "Super Site" UtahMore.com is promoted on the core newspaper sites under "home" but has its own url and navigation (image 4). The site includes:

a. MLS Bot large and central

b. Buyer rebate promotion

c. Leaderboard and righthand 300x250 (currently sold to two new home builders)

d. Featured properties (list form) and featured builder

e. Real estate news in the lower half of the home page

f. Nav bar includes Find a Home, List a Home, New Homes, Rentals, Commercial, Foreclosures and Lending

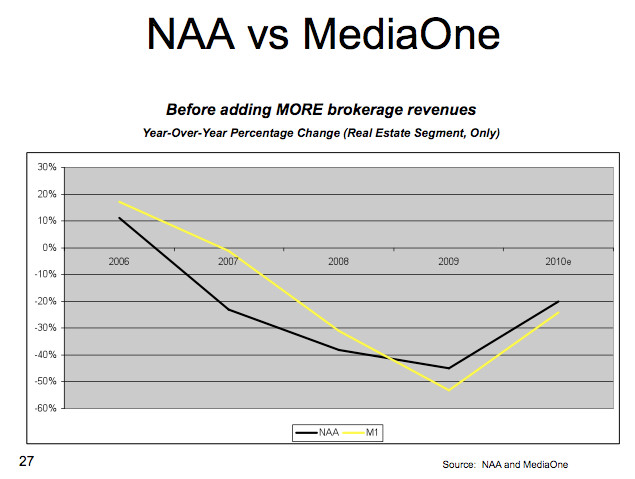

• Hard launch with aggressive advertising The ad campaign (image 1 to the right) blasted the discount around town with the headline “Selling Homes isn’t Rocket Science.” “We came right out of the gate with the ads that were over the top and right in the face of other brokers and agents," Low says. "I wouldn’t necessarily suggest that.” On-going promotions include newspaper advertising, e-mail blasts, signage, billboards, and advertising on public transit buses. "It’s pretty hard to miss us."

• Gain a competitive advantage by discounting listings To gain a disruptive advantage, the brokerage created a full service discounted listing. The fixed price, set at $2995, is the same for home worth $100,000 or $1 million (image 5 and 6).

• Deciding what to do about buyers To preserve advertising revenues from its largest real estate client, Prudential Real Estate, Low cut a deal to allow Prudential to act as Utahmore's buy-side representative. After a few weeks, however, the negative pressure on Prudential from the real estate community was so intense that they asked to be let out of the contract, which MediaOne allowed.

Their new strategy to attract buyers includes promoting a “rebate” on commissions via a check written to the buyer at closing. The rebate equals 20% of the gross commissions for the buyer’s agents (image 7 and 8).

"It works for the agent because they get many more clients that want to do this," Low said. Buyers can use the money to pay part of closing costs or get a check back after closing (Some lending restrictions and brokerage restrictions apply if the type of loan doesn’t allow for any more money to go to the buyer or if agent is not receiving a full 3% commission on the property).

• Recruiting agents and brokers Since a broker's license is required both to share commissions from agents and to obtain the MLS, MediaOne hired both a broker and associate broker, in case one left. The company started out by hiring agents as employees, however has since converted them to independent contractors who work for the broker. Most rent desks in the vacated classifieds area. Part of the on-going agent recruitment strategy includes running newspaper ads for home listings, with a photo and short write up about the agent. “It looks like we are promoting our agents, so it’s a recruitment tool to draw in other agents. If you work for Coldwell Banker, you are pushing the broker to do more marketing for you and your properties. MediaOne is everywhere. Other agents can see how we market our agents" (image 9).

• Managing leads A highly organized leads distribution system ensures that buyers are "called back" right away. Leads come in from numerous sources, but mostly from the site's MLS bot. Transaction coordinators collect the leads and distribute them to agents on a rotational basis.

• Optimizing the site The second phase of the brokerage marketing began when a new manager took over the site. Changes include:

a. “Obscessing over the SEO”

b. Investing in search engine marketing

c. Allowing agents to create independent sites (through a vendor, Pro Agent) nested within the main web site.

“These three things have moved us to the first page on most searches,” Low says. The site's design, with promotions at the top and news at the bottom, is also driven by how users navigate.

• Developing New products As the site evolved new products were also added, including For Sale By Owner (FISBO) classifieds and advertising for mortgage brokers and new construction. Additionally, packets of print inserts were developed to hand-out to new sellers and buyers, a great up-sell for home improvement services. Like short-run magazines, the limited number of packets produced make them highly profitable products.

Results: By December, 2010, UtahMore had 48 agents. By April 19, 2011 there were 60, with a compacity for 100 in the facility.The largest revenue stream comes from the brokerage, which had 400 listings after a year and a half. Revenues totaled $690,000 the first year and $1 million in 2011, in spite of the worst real estate market since the Great Depression.

In addition to real estate sales, the site averages $40,000 in digital advertising sales every month, “all of which is new revenues.” A traditional real estate classifeds section continues to limp along. The new print products, ie the advertising in packets given to both sellers and buyers, generate another $10,000 to $15,000,a month.

Traffic to the site is around 500,000 page views monthly. Traffic sources to UtahMore are as follows: 42% from newspaper web sites, 30% direct, 25% organic search and 3% other.

To track progress against its ultimate objective, owning the largest market share, Low consistently tracks UtahMore's listings against the total on the MLS. With 400 listings the company now had 3% marketshare in 2011. Coldwell had the largest share now with 7 offices and 12% of the market.

“Our goal is the largest brand in the market by the end 2012.”

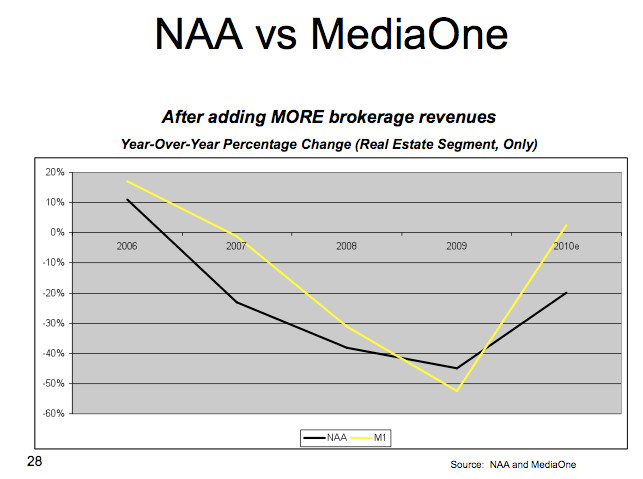

MediaOne of Utah has also begun to outperform NAA averages in revenue growth, largely as a result of this initiative (images 11 and 12).

Lessons learned

1. A down real estate market can be an advantageous time to launch because of reduced competition. “That's the perfect time to launch because if we can establish market share right now, when (the market) comes back we are going to be in an awesome position.”

2. Create a soft launch, rather than attack the real estate community outright. “If we had to do it over again, we would have a soft launch that was not as aggressive” in terms of the "in your face" message. The real estate community will not happy that that a local media is now competing, but since agents collaborate on deals, fanning the flames is not always productive.

3. There was not as much price elasticity as expected for listings, Low says. "In retrospect, we would have gone more on the buyers side rather than just the sellers side right away.”

4. Don't over-estimate the importance of current advertisers. When calculated lost revenue from the real estate category, only include brokers and agents; since other categories will not be affected and some will actually increase. Chasing the one significant broker-advertiser ultimately failed anyway, at MediaOne while revenues from the brokerage quickly replaced and exceeded losses.

5. Count on additional new revenue after the site and brokerage are fully functional. “We didn't even think about that when we launched.” Key sources include advertising from mortgage and title companies, FISBO's, and the print packets.

6. A key metric for brokerages is share of MLS. Set up a culture that tracks that percentage against predetermined goals. Start by analyzing who owns what marketshare using percentage of MLS listings as a gauge.

7. Go to market with promotions full-throttle and enough agents. While Low says he would not recommend a hard launch and "in-your-face" campaign, part of the success of the new company is "being everywhere."

Our take: This is a robust and largely over-looked revenue model like many of the user-generated revenues concepts we've talked about on this site. A more "toe in the water" approach taken at Sanjose.com, which implemented this model as early as 2008, includes sharing revenues with a few off-site brokers or agents. However, the 'all in' model this company adopted yields significantly higher dollars overall.

Many thanks to Brent Low, CEO of MediaOne of Utah, for sharing his expertise and experience and slides with our members, and to NAA's MediaXChange, where Low first presented these results.

The author, Alisa Cromer is publisher of a variety of online media, including LocalMediaInsider and MediaExecsTech, developed while on a fellowship with the Reynolds Journalism Institute and which has evolved into a leading marketing company for media technology start-ups. In 2017 she founded Worldstir.com, an online magazine, to showcases perspectives from around the world on new topic each month, translated from and to the top five languages in the world.