NewOrleans.com converts to a travel site

Using software from Vegas.com, NewOrleans soaks up new revenues

Media site: NewOrleans.com

Owner: Hammack Jones Interests

Key executives: Bill Hammack, Chairman; Don Jones, CEO

Initiative: Converting to a visitor-based site

Summary: NewsOrleans.com converted to a travel site this year, using technology supplied by Vegas.com. The strategy has allowed the site to differentiate itself more significantly in the travel space - and paradoxically create a new local strategy (find more information on "How to build a travel products strategy" here).

Background: Neworleans.com was founded in 1996, and spent 15 years primarily as an online travel agency serving tourists to the city. The original owners of the company developed a successful Internet and call-center hotel reservation engine, TurboTrip before selling it to Hotels.com, preserving an affiliate relationship for the website.

Challenges: The 2009 economic downturn led the company to quickly reconsider its direction. Key challenges for the site included:

•Timing. The purchase date was February, 2008. The Dow Jones was above 14,000. Six months later, things had changed. As Jones says, ”it was like you are in a poker game and make a bet, then look down and half your chips are missing.”

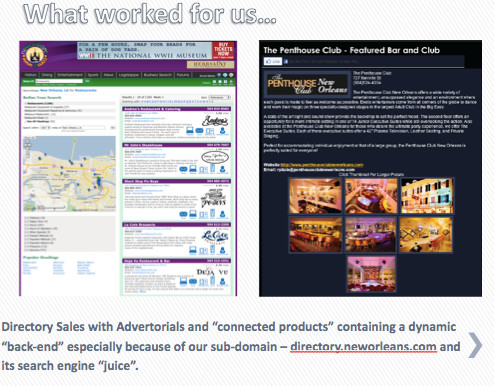

•Too many small, unprofitable ads. The site was filled with small banner ads that had a low renewal rate. "It was inexpensive and noisy; 50% of the content on the page was small ads." One of the first moves was to shift to two to three ad positions.

•Offering credit terms with a low priced product set. Sales people needed to be trained to get the payment upfront; the best low key approach to asking for the money, came from one sales representative who told her advertisers, simply, "It's customary."

•Confusion of focus between locals and tourists. Each type of advertiser had a different perspective – some wanted locals, some visitors. "We had to decide, who should we focus on."

•Turnover in trained sales representatives. Trained sales representative became very valuable in the market and were picked off by other legacy sales organizations moving into electronic media.

•The competitive landscape. NewOrleans.com, as a pure-play site, needed to sell ad inventory; but prices were dragged down by the tendency of local media to give away their online inventory. "It was the drowning man syndrom," Jones said. "A drowning man tried to yank who is next to them for survival and ends up pulling down both of them...(newspaper sales reps) were saying 'please keep your print program and we'll give you the internet for free.'"

The company took advantage of its history in selling local and tourism markets to make its most important strategic decision:

1. Selecting the tourist audience as its only focus. The decision was a pragmatic one The experience of having a segmented site; yielded important information: "Visitors didn't want to go to a section called visitors." Paradoxically, locals did want to go to a visitors site. So the choice to focus on visitors instantly differentiated the site's market position:

*NewOrleans.com would not have to compete head-to-head with legacy media sites for local residents.

*Conversely, as an historically local site, NewOrleans.com had much deeper local content than national travel verticals like Travelocity.com or Expedia.com. "We are experts on NewOrleans; we can be a mile deep instead of 50 feet deep."

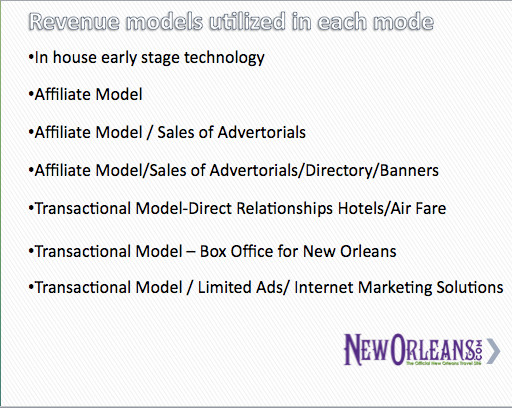

2. Shifting the business model to transactional, with advertorial profiles.

The business model in NewOrleans.com has always relied in part on transactions from hotel room sales, but evolved over time through the following stages:

1. Development of software to sell hotel rooms (TurboTrip, eventually sold to Hotels.com)

2.Continuing to use Hotels.com as an affiliate.

6. Shifting to a full to visitor's guide model; transactional sales expanded into a role as the box office for new Orleans, with only limited ads.

7. Adding internet marketing solutions that serve consumers and advertisers, built around "jobs to do" in the tourism market.

3. Licensing a software platform from Vegas.com

A partnership to use software from Vegas.com supplied the technological infrastructure for a full visitors model in NewOrleans. "We weren’t satisfied with 4% (from affiliate sales of hotel rooms); we want to utilize the technology but control the relationship. Vegas.com has a huge, deep business centered only on Las Vegas."

4. Developing channels and more transactional elements

The site is now segmented into channels that support what visitors do then they come to New Orleans:

*Hotels and travel. These relationships are set up directly by a sales staff; like most travel bots the technology itself is a simple widget on the lefthand side of the site plus a large "Make reservations" button on most content pages, including attractions and dining.

*Tours. Tours are also sold directly from the site today; the goal is to add a variety of attractions to be the "box office" for NewOrleans.

*Mardi Gras Guide. The company has licensed content from the Mardi Gras Guide, to create deep content; currently hotel sales are promoted on the Guide, but the pan is for a variety of activities to be sold on site.

*Sports. The active sports franchise that covered local prep sports was considered too local for the new model; however, too much traffic to shut down. The area has been parked; ie turned over over to a local TV station to operate, NewOrleans.com is not taking a revenue share.

*Dining. the dining section has two full time writers for review and blog. The current product is an advertorial placement in "Top Five" dining lists; and the company is in the market for a dining reservations transactional service, such as OpenTable, and has not selected one as yet.

5. Focus on the "before, during and after" visitor experience

The new way of looking at content allow for a variety of new initiatives, such as allowing visitors to make purchases from their cell phones while in NewOrleans, or, as an example, to build photo galleries of their stay after the fact. These initiatives are still in development stage.

Results

*Traffic is more targeted, but smaller. After growing traffic from around 25,000 monthly UV's in 2008 to 300,000 by 2011, switching to a transactional visitor-based model reversed that trend. Current traffic runs around 80,000 a month, swelling to 100,000 prior to Mardi Gras.

*Conversion percentages are in the middle end of the range for travel sites. Jones says conversions (transactional sales) for travel sites are typically at .25% at the low end for travel sites, .5 to .75% in the mid range and 1% to 2.5% as "very good." Business travel markets tend to have higher conversions than tourist markets because of the forced nature of the sale.

Lessons learned

Don Jones gave the following advice to city.com owners at a recent meeting of the GeoPublishers association:

*"Utilize analytics to “fish where the fish are”... to see who is using your site and to find out where people are coming from. We have people in Louisiana on our site booking rooms."

*"This is a city with 12 million visitors, so (a tourist-oriented site) made sense for us as a business. There is no silver bullet, however, (for all city.com sites). You have to decide from a competitive perspective which group of ideas work for you."

*"Look for natural local relationships that ad value without conflict."

*"Advertising competes with the transactional business model. The ad distracts people from the buying process. You make less money by selling advertisng on that page." Thus, the new NewOrleans.com only carries limited display ads.

*"We have a shopping carte mentality, while you are making the reservations, we want you to go out and buy the fixed price meal, tickets to a tour, the zoo, or to festivals and events or even Bourbon sreet balconeys, put it in the shopping carte and purchase it." The abilty to buy acitivities, and then mobile site, is coming in phases.

*"What we did to build the local audience worked; we would still be in the local business if it were not for economic reasons. (Local models for city.com sites) will work, it just didn’t work effectively at the scale we were trying to do it, because of timing and the economy."

For more information, go to "How to create a travel products strategy."

Many thanks to Bill Hammack, Chairman and Don Jones, CEO of NewOrleans.com for sharing their experiences with us, and to the GeoPubishers Association, who invited them as speakers to its first conference in 2011. Geo Publishers has purchased subscriptions to LMI for all of its members.

The author, Alisa Cromer is publisher of a variety of online media, including LocalMediaInsider and MediaExecsTech, developed while on a fellowship with the Reynolds Journalism Institute and which has evolved into a leading marketing company for media technology start-ups. In 2017 she founded Worldstir.com, an online magazine, to showcases perspectives from around the world on new topic each month, translated from and to the top five languages in the world.