Deseret Media's eight strategies that capitalize on market disruption

CEO Clark Gilbert focuses on mobile innovation in Salt Lake

Summary: When Harvard academic Clark Gilbert helped create the Newspaper Next project, making recommendations on how newspapers should deal with disruptive change, not many media companies took his advice.

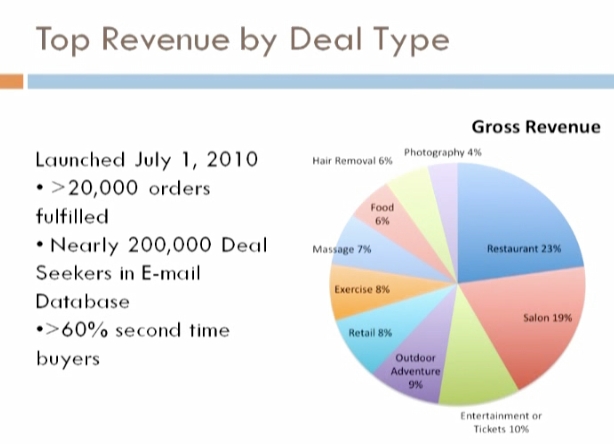

But in 2009 he left Harvard to take a job as CEO of Deseret Media and put his theories to work. Restructuring efforts have included massive layoffs - 43% in editorial - but have also paid off in spades. Digital revenues increased 60% year over year and are showing consistent month over month growth. The mobile site is now the fourth largest internet provider in the state - just behind the daily newspaper site. New deals programs launched in July have created 20,000 transactions from 200,000 opt-in users. And KSL.com is poised to exceed sales of the radio division within a year.

Traffic: 25 million pageviews, 5 million UV's

Company: Deseret Media Group, owners of broadcast, radio and print sites

Owner: Church of Latter Day Saints

Market: Salt Lake City, Utah

Key Executive: Clark Gilbert, President and CEO

Strategy: Gilbert's strategy builds on some of the unique strengths of LDS-owned Deseret Media: Its huge national audience as a "voice for (the church) values," the giant base of users already actively posting free classifieds (larger by 40% than Craigslist), a number of trusted legacy brands that include Deseret News and KSL TV, and vast, for the newspaper industry, investment resources. To this mix, Gilbert added his own vision for tackling disruptive innovation by creating parallel businesses.

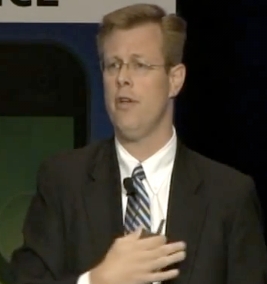

1. Corporate reorganization. The new division created, Desert Digital Media, takes lessons learned from studying the survivors of technology disruption, in particular using theory in The Innovator's Dilemma, a ground-breaking study by Harvard colleague Clay Christensen. Of the 800 companies studied, only 9% successfully responded to the disruptive threat, and of these, 100% had a separate division.

The new Deseret Digital company has its own building, sales force, executive team and profit and loss statement.

"(Separating) does not guarantee success, but it was a necessary precondition. I've given this recommendation for ten years. I'm not interested in arguing; the evidence is overwhelming and inarguable."

The leading internet site, KSL.com was also rebranded from a media company to a "transactional marketplace." In the next year it would grow from number two to the number one media site in Utah. The giant free classifieds channel on KSL was also separated into its own business and mobile was recreated as a complete new business unit.

2. Developing the digital sales force. Separate sales force includes support for traditional sales teams. But on its own, the digital sales group has grown from about 30% to 65% of the total sales force, divided into the direct selling internet team, "long-tail focused" telesales and direct to site self-serve support. The traditional sales force also grew, so there was no cannabilization. "Do not run away from the traditional sales force," he says, but invest in digital and mobile sales representatives.

3. The new role of the CEO. Gilbert is the first president and CEO of Deseret News, the newspaper, as well as of the newly created Deseret Digital Media, with publishers reporting to him through the new chain of command. As CEO he is both chief innovative strategist and a human bridge who can integrates companies and brands as needed (changes in roles of publishers have been discussed previously here and here).

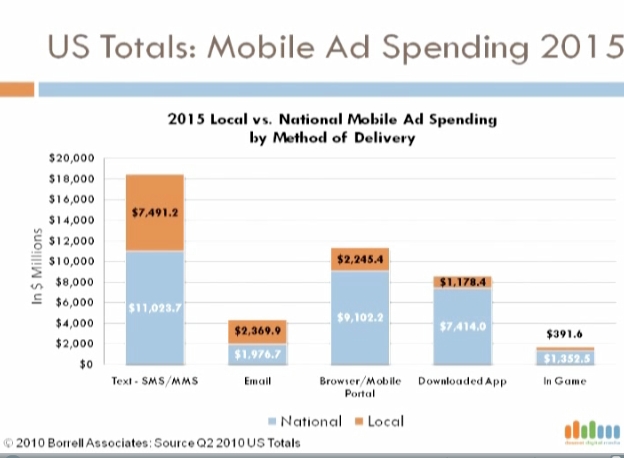

4. Separate organizational structures for mobile too. With mobile products and services threatening a similar industry disruption, the new internet company also began a parrallel mobile division with it's own team, P&L and sales force.

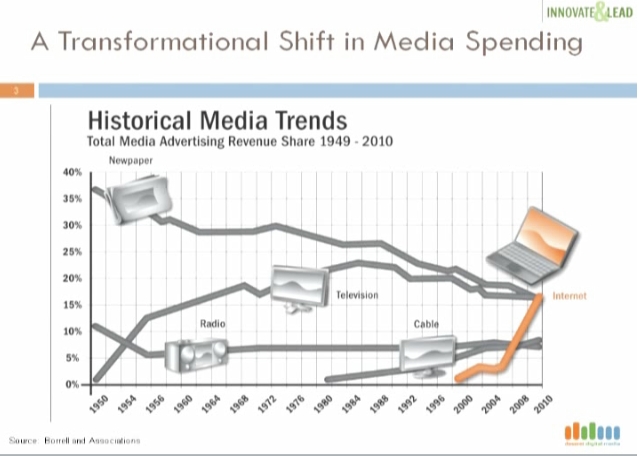

"If you think of the history of disruption (in the computer industry) from mainframes to mini-computers to personal computers" he says, in media the order of disruption has been the same, only it has gone from "mainstream media, to computer to mobile."

"We (at Deseret Interactive) are just as susceptible to mobile disruption as anyonelse. I feel it every day. I have to pull back and set up different organizations and different investment for mobile. It's a different business."

(Borrell top executives echoed this theory, posing the "litmus test" of whether you have sales reps "you can fire" if mobile goals are not met.)

Even with a mobile sales force, acquiring the first mobile display customers was difficult.

"For the first couple of months we couldn't get anyone to put the ad on mobile. We would say, there is no one there on the site, your ad will get 100% SOV," but no one ponied up. "Now that there are a few advertisers, however, getting 2 to 3 times the click through rates, they don't want anyonelse to know about it. The market is starting to warm up."

5. Hiring outside the media industry. Besides the healthy size of the sales force in the new digital division, executive leadership also includes digital talent from outside the media industry. Deseret executives include former leaders at Overstock.com and other major national pure plays from Ancestry.com to Yahoomail and Blockbuster.com, who never worked at a media company before. Gilbert considers this to be "hiring digital DNA" and an important part of the new strategy.

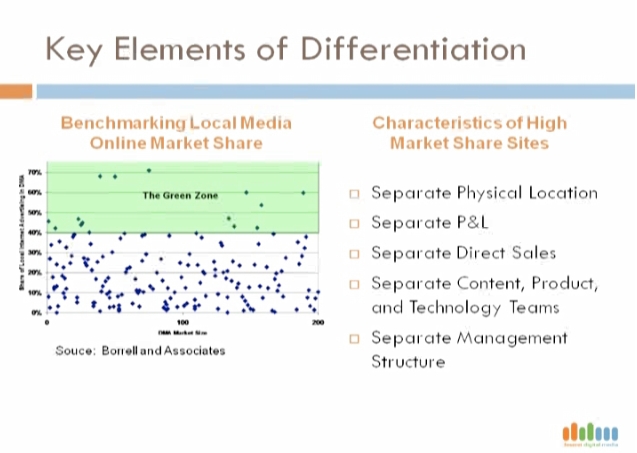

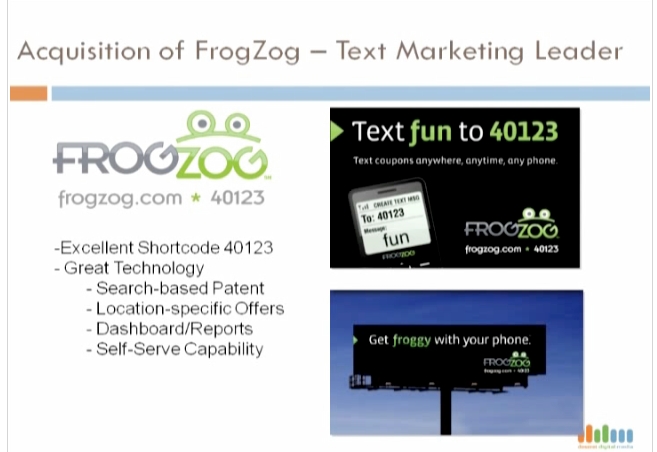

6. Acquisition of disruptive technology companies. Deseret Media focused on texting as a growth opportunity (see chart attached) and purchased a text-based mobile marketing company, FrogZog who has unique technological capabilities.

FrogZog specializes in text messaging and has a number of advanced features. The original executives now lead Deseret's mobile division. Besides offering a texting and short code service, FrogZog's technology has the following advantages:

• The ability to search mobiley for coupons using patented technology.

• Customer self-service to change offers and locations on the fly, allowing the technology to service "thousands of long tail customers that would be too expensive" to be handled by a standard sales force.

• Dashboard that customers - and their sales representatives - can access to track offers, locations and short codes.

The dashboard is being redeployed to include real time reports on banner ads and email campaigns. "Customers can look across their network busy within two or three hours of deploying a campaign, and see all the data without calling a sales representative."

• Instead of a short code for every offer, FrogZog can use a general code, and have the name of the company in the offer, so customers can search by company, recieve and redeem the offer, on demand.

Like other products, FrogZog's texting service is white-labeled by the legacy brands.

7. Exploiting self-serve to expand the customer base. While the radio and television divisions have about 400 and 200 advertisers respectively, the digital company has a base of 1,500 customers and growing. Gilbert sees most of this growth coming from the kind of self-serve solutions inspired by Google Adwards, since advertisers no longer require sales representatives to entertain them at lunch. In fact in many cases they do not require sales representatives at all.

"Most customers are saying I just want to run my business I don't need your tickets to the jazz game." With self-serve dashboards, these companies can "change their offer and never talk to anyone. It allows us to talk to thouasands of long tail custoners." Dashboards created by FrogZog for texting are being integrated with banners and email products so customers will be able to "look across the network and see what is working for them, real time. In two or three hours they can make a deicison, pull a banner down or double up on texting."

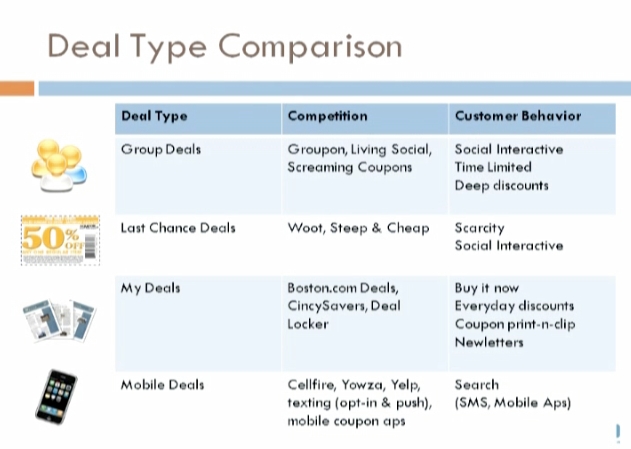

8. Launching four deal products as part of the mobile division

Gilbert sees the coupon market as the kind of "new market of customers" where disruptive innovation starts before edging into higher end traditional markets - and edging out legacy media. This makes "mobile frugality" a key marketplace for media companies to invest in now. Searchable, on-demand mobile coupons deals "is a more powerful than better model than going home and printing them, and bringing them with you."

All of the deals are white labeled as legacy brands: "The one legacy asset we have is the brand trust we have. Its the only asset. Not to harvest that is crazy."

The four types of deals below, the first two deployed in July and the last two in development as of October, 2010:

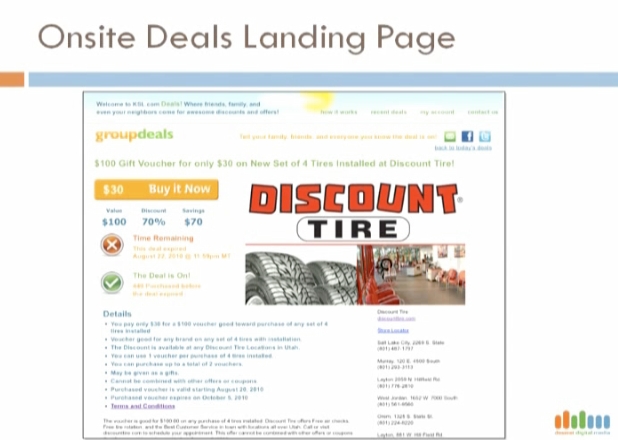

a. Group Deals. Defined by social behavior, group deals don't "tip" until so many are sold, and have deep, 50% plus discounts. The new Deseret Deal, has yielded huge revenues for Deseret, who took an unusual course of develop and launch (and succeeded within two months) a daily deal without a technology partner. While not a model that most companies can emulate (McClatchey caved and partnered with arch rival in the space Groupon, without so much as a white label), Gilbert points out that if you have to partner, a white label versions the best option and Groupon partnerships are to be avoided. He argues Groupon should be shunned even as a display advertiser on your site.

"The one asset you have is your consumer trust in your brand and you decouple that, when partnering. Do not do this outside of your own brand," Gilbert advises. Of Groupon, he says, "They will harvest your brand (for email addresses) and as soon as there is a slight decline, they will leave you." Not only is Groupon gone, so is your potential email list for a daily deal program. Ouch. Gilbert kicked Groupon off his site. (More information on daily deals is here).

b. LastChanceDeals. Buyers for these deals are motivated by exclusivity and scarcity; who get to find one time sales "while they last." Deep discounts become richer throughout the day, until at the end of the day they are gone (this as opposed to group deals which tend to have an early push).

c. MyDeals.com. This idea was borrowed from boston.com and cincisaver.com. The deals tend to have smaller discounts, but are offered everyday or on a regular basis, with a lot more choices which can be customized to the customer so that customers feel, "This is just way I shop." Mydeals opt-ins allows customization by category. Newsletters are very customized. Advertisers also target so the customers are not spammed with to many emails.

d. MobileDeals.com. Similar to mydeals.com, MobileDeals is designed to offer every day discounts but also offers search on Frogzog's network of merchants, or can be pushed by merchants via text.

Having four kinds of deals with different customer "behaviors" allows Deseret to develop "the total space" without competing with each other.

Results:

While mobile display has been slow going, deal revenues shot up immediately. Deseret has completed 20,000 transactions, with a 60% repeat rate since the July, 2010 launch. "Get the deal" ads on KSL.com and other sites has generated a 200,000 person email list. The sites are optimized so that daily deals compete with remnant ads to maximize return.

KSL.com has grown from the second largest to the largest media site in the state, as well as being the larget local television site in the country. The mobile site is now the fourth largest internet site in Utah. "If they are not careful it will become the number one."

Digital services are showing strong month over month growth - 60% year to year as a whole. Gilbert anticipates that new sales revenues will eventually be be about a third, a third, a third in terms of the split between the telesales, self-serve support and feet on street, in the future.

Lessons learned

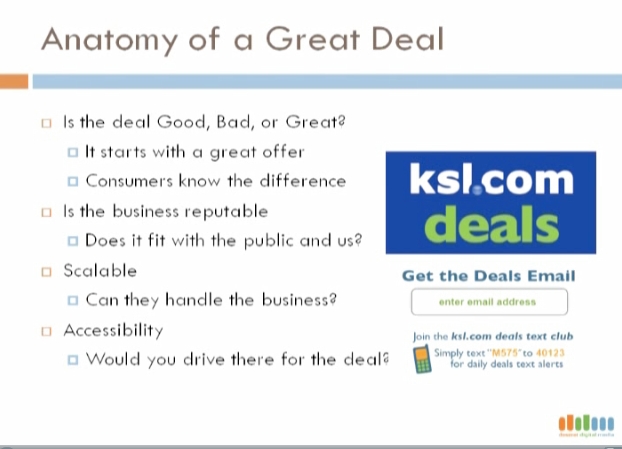

1. Find great offers: In the deal space, a great offer is quintessential. "We have ad policies around decency... with deals we are also very selective." Gilbert point out that group deals "turn the tables on the advertisers. We are going to check you out first. You are the client in advertising, but in deals we are partners...When I pick a bad deal of the day even if it generates $2000, it could have generated $5000, and you just cost me $3000 today." If the client doesn't want to give 50% off, they are placed in a different deal product.

2.People count. "One of the big things I learned switching from academia is that strategy is never more th 49 % of solution. You have to have the right people." Hire extra "digital DNA" by looking outside the media industry.

3. Separate or perish. Without creating new business units with separate sales, management and profit and loss statment, "traditional media overwhelms (new media initiatives)... That always makes sense to everybody...until you're dead."

4. Invest in new business models. At the Borrell Mobile conference an attendee told Gilbert that it did not seem realistic for other local media companies without the resources of the LDS Church to create this kind of investment. His answer was clear, "The question is how can you not do this, or do you just want to ride this until its over. The question is if you are going to invest, or are you going to sell? Do you want to ride this thing down?" There is a new sense of urgency here, industry wide. Gordon Borrell has gone as far as to recommend that executives whose companies did not give them enough resources to build a mobile presence should consider finding a new job.

5. Embrace performance as the end goal for advertising. Letting customers choose products based on performance that shows up on a dashboard, "So far has not cannibablised" legacy products. "We've brought in new customers."

6. Treat Mobile as disruptive to PC based sales. "It's not who has the solution, who has the organization that can adapt and learn."

7. Look for national brands within the local brand, that can be expanded. These include universties, sports teams, people who used to live in the city, or things that the city is known for such as politics in Washington or tourism in Las Vegas.

The author, Alisa Cromer is publisher of a variety of online media, including LocalMediaInsider and MediaExecsTech, developed while on a fellowship with the Reynolds Journalism Institute and which has evolved into a leading marketing company for media technology start-ups. In 2017 she founded Worldstir.com, an online magazine, to showcases perspectives from around the world on new topic each month, translated from and to the top five languages in the world.